The Bitcoin maximalist versus crypto diversifier debate is framed as ideological warfare, but beneath the social media battles lies something more fundamental—these are expressions of entirely different personality types. Your preference reveals as much about your psychological makeup as your financial analysis.

The Bitcoin Maximalist Profile

Bitcoin maximalists hold singular conviction: Bitcoin is the only cryptocurrency that matters. They view it as digital gold and the inevitable future of money.

Core traits: High conviction, clarity-seeking, comfortable with concentrated positions, resistant to FOMO, values simplicity over complexity, drawn to first principles thinking.

Stress response: They become more convicted during crashes, viewing downturns as validation that weak projects are being eliminated.

Blind spots: Can dismiss legitimate innovation in other cryptocurrencies. May miss altcoin cycle opportunities while waiting for long-term Bitcoin appreciation.

The Crypto Diversifier Profile

Diversifiers maintain positions across multiple cryptocurrencies, viewing the space as an emerging technology sector rather than singular monetary revolution.

Core traits: Opportunity-seeking, complexity-comfortable, risk-spreading instinct, intellectually curious about multiple technologies, drawn to portfolio optimization.

Stress response: They rebalance during volatility, taking profits from winners and adding to losers. Market chaos creates portfolio management opportunities.

Blind spots: Can become overwhelmed by too many positions and dilute returns through excessive diversification.

The Personality Split

Maximalists often exhibit similar patterns across life: focused career paths, deep expertise in narrow domains, strong philosophical frameworks. Diversifiers show complementary patterns: varied interests, comfort with ambiguity, broad knowledge, pragmatic flexibility.

Neither approach is superior—they’re optimized for different personalities in different market conditions. Long-term return data doesn’t definitively favor either. Maximalists achieve returns through conviction and patience; diversifiers through activity and timing. Same destination, entirely different psychological journeys.

Your sustainable crypto strategy matches your natural decision-making patterns, not the loudest advocates.

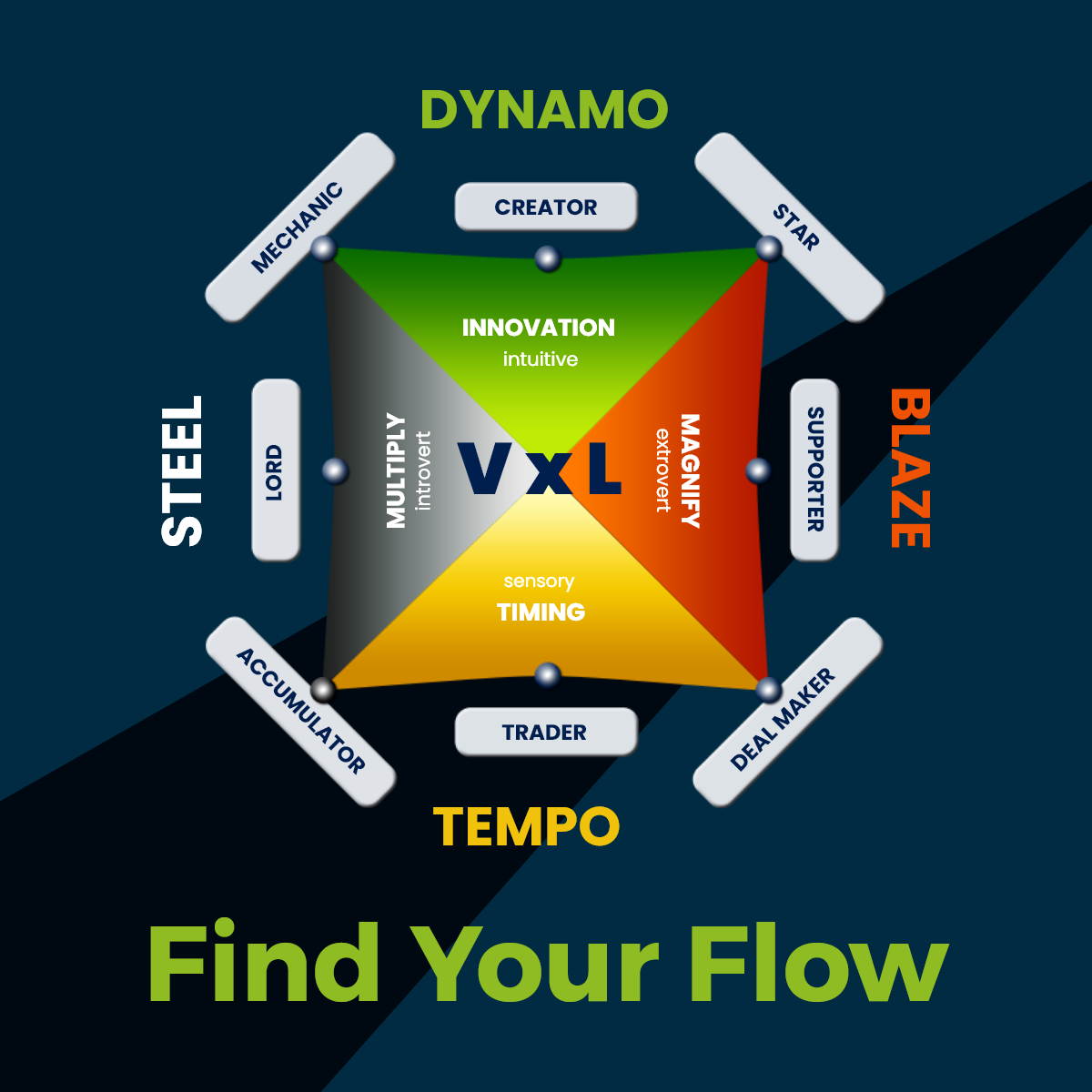

Your crypto investment style should match your personality type, not popular opinion. The Wealth Dynamics Test can uncover whether you’re built for concentrated conviction or diversified strategies—and how to build sustainable wealth using your natural strengths.

Then deepen your understanding with The Bitcoin Standard microcourse at Genius Academy, where Saifedean Ammous explores the economic foundations that make Bitcoin unique.