Bitcoin holders often embrace the technology for its independence and self-sovereignty. But that same independence creates a problem nobody wants to discuss: what happens to your Bitcoin when you die?

Unlike bank accounts and investment portfolios, there’s no institution standing by to transfer your assets to your heirs. If you don’t put together an inheritance plan, your Bitcoin doesn’t go to court, it simply vanishes.

The Lost Bitcoin Problem

Estimates suggest millions of Bitcoin are permanently lost, as they are held in wallets whose owners died without sharing access information. Those coins will never move again; they’re functionally destroyed, removed from circulation forever, yet locked in blockchain ledgers as a permanent monument to poor planning.

This isn’t a theoretical concern. It’s happening to Bitcoin holders who believed they’d figure out the inheritance question later.

The Technical Reality

Bitcoin inheritance requires solving a problem that traditional assets don’t face: how do you pass a private key to your heirs without exposing it to theft during your lifetime?

Private keys are the only way to access Bitcoin. Whoever holds the key owns the Bitcoin, period. There’s no “forgot password” recovery, and certainly no bank manager who can help. If your heirs don’t know the key, they can’t access the Bitcoin, regardless of what your will says.

Therein lies an uncomfortable situation: you need your heirs to know how to access your Bitcoin, but you can’t store that information in obvious places like email, safes, or password managers without creating security vulnerabilities. And if you give the key to your heirs while you’re alive, how much do you trust them not to steal your prized asset?

The Practical Approaches

Hardware Wallets with Backup: Store your private key (seed phrase) on a physical device, then keep a backup copy in a secure location your heirs can access after you die. The challenge is making it secure enough that thieves can’t find it while obvious enough that your family can.

Multisig Wallets: Divide access among multiple parties so no single person can access your Bitcoin without others. Your heirs might hold one key, a trusted advisor another, a lawyer a third. This requires coordination and cooperation.

Dead Man’s Switch Services: Automated services that send your Bitcoin to heirs if you don’t check in regularly. These introduce third-party custody risks and require ongoing maintenance.

Self-Custody with Documented Instructions: Write clear instructions about wallet locations and security practices, then store them somewhere secure and legally protected. A lawyer should be involved.

Cold Storage Inheritance Protocols: Services designed specifically for Bitcoin inheritance, where you create instructions that execute after your death.

What Your Will Can’t Do

Your will cannot transfer Bitcoin directly, nor can courts order Bitcoin transfers. Your will can only specify who should inherit your Bitcoin and provide instructions for accessing it. The actual transfer requires your heirs having your private key information or multisig coordinates.

This means Bitcoin inheritance requires planning outside traditional legal frameworks.

If your Bitcoin is meant to be part of your legacy, you need to address this now. Waiting creates risk, as the longer you wait, the more likely you die unexpectedly with no plan. The conversation needs to happen with both family and professionals who understand Bitcoin.

Start Planning Now

Your Bitcoin inheritance plan should answer:

- Where is your Bitcoin stored?

- How do your heirs access it?

- Who do they contact if something goes wrong?

- What happens if multiple heirs disagree?

- Are there tax implications for transfers?

The answers depend on your specific situation, but the planning needs to happen before you need it.

Master Bitcoin Economics and Planning

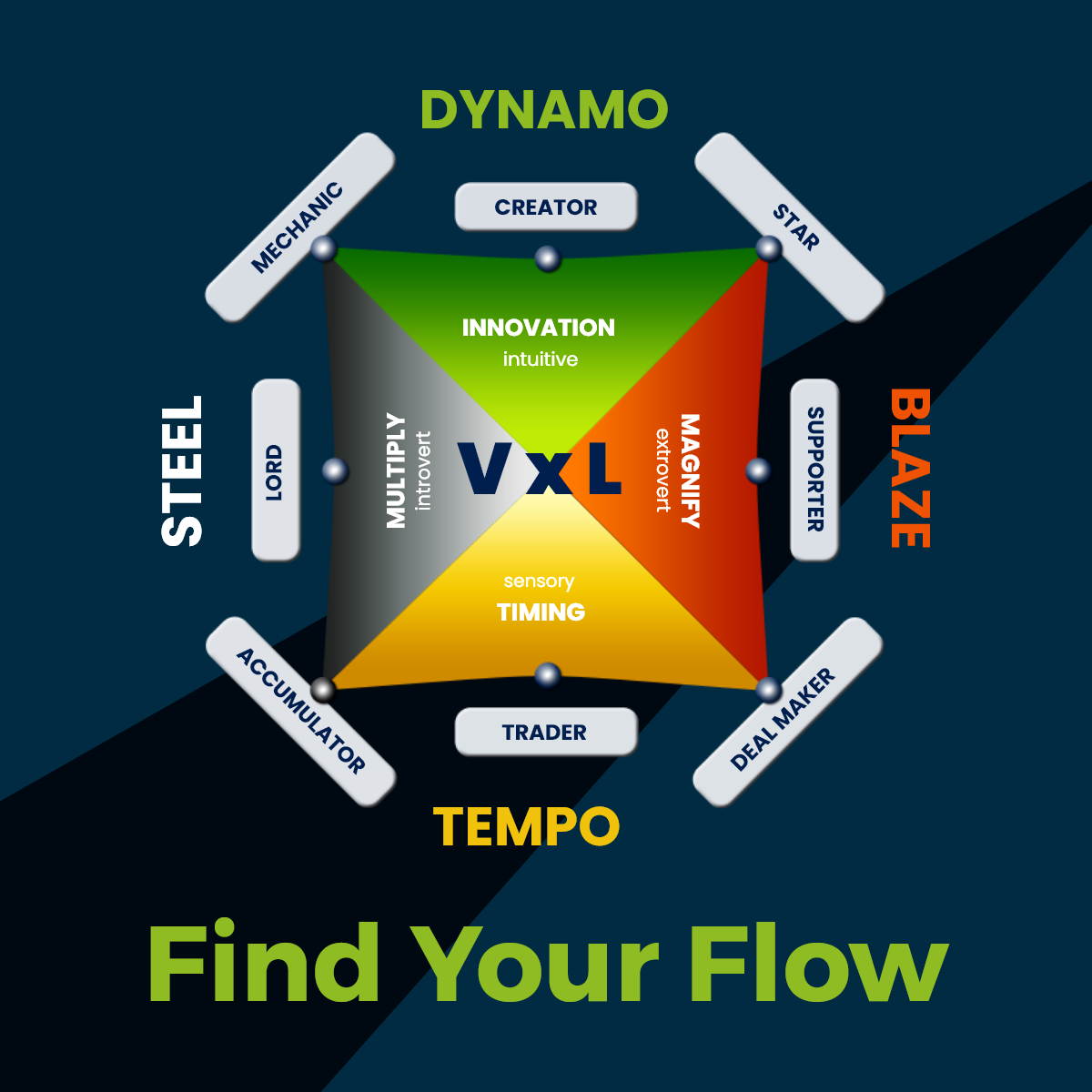

Bitcoin inheritance planning is just one piece of building generational wealth with digital assets. The most sophisticated Bitcoin holders often don’t figure this out alone; they learn from a community that lives and breathes Bitcoin economics, security practices, and wealth preservation strategies.

Genius Academy connects you with a global network of Bitcoin-first entrepreneurs and investors. Plus, you can take microcourses like Saifedean Ammous’s “The Bitcoin Standard” and Natalie Brunell’s “How Bitcoin Fixes Money” to deepen your understanding of Bitcoin.