You understand Bitcoin, you’ve gone down the rabbit hole, and you see the monetary revolution unfolding.

Now you want to teach your kids about it without becoming the parent who homeschools their children in Austrian economics and rants about fiat currency at soccer games.

Here’s how to introduce Bitcoin as financial education instead of family ideology.

The Warning Signs You’re Going Too Far

Your eight-year-old asks for allowance and you launch into a 20-minute explanation of monetary debasement. Your teenager rolls their eyes when you mention “sound money” for the third time this week. Then, your spouse gives you the look when you suggest the family vacation discussion should include a lesson on Bitcoin’s fixed supply versus inflationary tourism costs.

If any of these sound familiar, you’ve crossed from education into evangelism, and your kids have stopped listening because they’ve heard this sermon before.

Start With Money, Not Bitcoin

Before explaining Bitcoin, make sure your kids actually understand regular money. Most children think money appears from ATMs through parental magic and disappears through mysterious adult transactions called “bills.” Start there.

Teach them that money represents work and value. They do chores, they earn money, they can exchange it for things they want. This fundamental understanding matters more than blockchain technology, and it’s where most financial education should begin regardless of whether Bitcoin enters the conversation.

Once they grasp that money is earned through providing value to others, you’ve laid groundwork that makes Bitcoin’s value proposition make sense without requiring missionary zeal.

The Comparison Approach

When your kids understand basic money concepts, Bitcoin becomes an interesting comparison rather than a radical ideology. You can introduce it naturally through questions rather than lectures.

“You know how you have money in your piggy bank? What if there was money that only existed on computers, and nobody could make more of it whenever they wanted?” This opens conversation instead of closing it with overwhelming information.

Compare Bitcoin to things they already understand. Digital money is like email, in that it goes directly to someone without needing the post office. Limited supply is like their favorite collectible cards, where only a certain number exist and why some are more valuable.

These comparisons create curiosity without requiring your children to become monetary philosophers before they’re old enough to stay home alone.

Age-Appropriate Complexity

For young children, Bitcoin is simply digital money that you can send to anyone in the world through the internet, and there’s only a limited amount that will ever exist. That’s enough. They don’t need to understand proof-of-work consensus mechanisms or the Byzantine Generals Problem.

For teenagers, you can go deeper into why scarcity creates value, how inflation affects savings, and why decentralization matters in a world of centralized control. But even then, keep it conversational rather than educational. Nobody likes being lectured, especially not teenagers who already think they know everything.

The goal is planting seeds of financial literacy, not creating junior Bitcoin maximalists who alienate their friends at lunch with passionate defenses of digital scarcity.

Let Them Experience It

Theory is boring, but experience teaches. Instead of explaining Bitcoin’s superiority, let your kids actually use it in small amounts. Set up a simple wallet, send them a tiny amount of Bitcoin, and let them watch the transaction confirm on the blockchain. Help them understand how to secure their private keys.

This hands-on experience creates more understanding than any explanation of monetary policy ever could. They’ll remember sending Bitcoin to a friend or buying something with it long after they’ve forgotten your carefully constructed arguments about inflation.

Consider giving them the option to receive part of their allowance in Bitcoin. Let them decide how much, and let them experience the volatility—both the gains and the losses. Real financial education includes understanding risk, not just ideology.

Avoid the Missionary Position

The fastest way to ensure your kids reject Bitcoin is making it your identity. If every family conversation somehow circles back to Bitcoin, if every financial question receives a Bitcoin answer, and if you’ve made cryptocurrency your personality, your kids will rebel against it simply because teenagers rebel against whatever their parents are obsessed with.

Bitcoin should be part of their financial education, not the foundation of their worldview. They should understand it as one tool among many for managing wealth, not as a quasi-religious movement requiring devotion.

Your kids need to form their own relationship with money, investing, and financial philosophy. Your job is providing information and experience, not demanding ideological alignment.

When They Ask Hard Questions

“Dad, isn’t Bitcoin just for criminals?” “Mom, my teacher said Bitcoin wastes energy.” “Why doesn’t everyone use Bitcoin if it’s so great?”

These questions are opportunities for honest conversation, not tests of your ability to defend Bitcoin against all criticism. You can acknowledge legitimate concerns while explaining your perspective without demanding they accept it.

“Some people do use it for crime, just like they use regular money for crime. Most people use it legitimately.” “Bitcoin does use energy, and people debate whether that’s worth it. Here’s how I think about it.” “Not everyone uses it because people have different ideas about money, and that’s okay.”

This teaches critical thinking about financial topics instead of blind acceptance of your conclusions.

If they grow up, understand these concepts, and choose traditional finance anyway, you’ve still succeeded in providing financial education. If they grow up rejecting Bitcoin because you made it insufferable, you’ve failed.

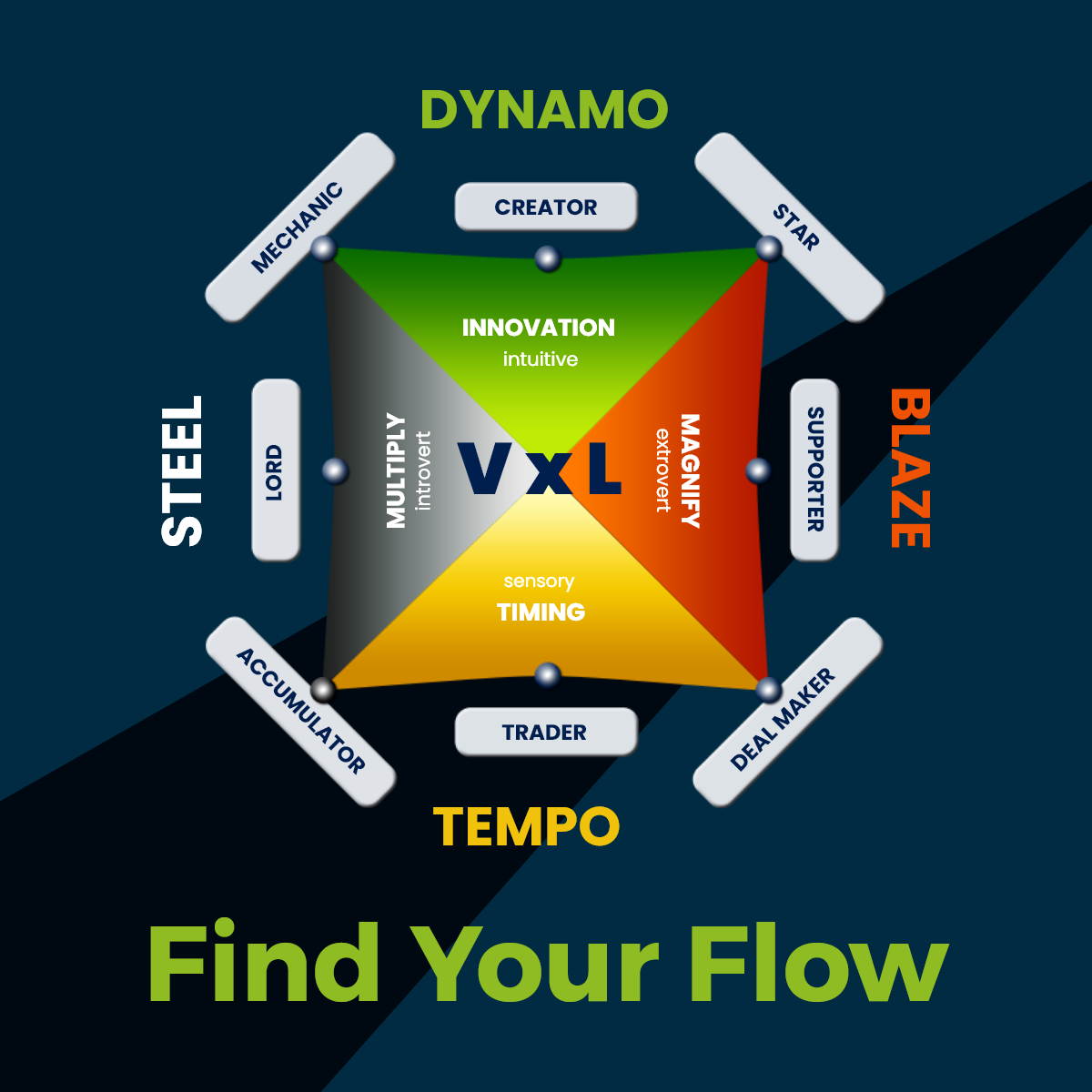

Teaching kids about Bitcoin is part of broader financial education that includes understanding money, value, and wealth building across different systems. But learning doesn’t have to be age-specific; you, too, can brush up on all things Bitcoin. With your children, head on over to Genius Academy for microcourses (short and punchy, much like how kids like content these days) on Bitcoin and more.