In the modern world, where the economy is constantly evolving, it is important for traders to have a good understanding of the market if they want to succeed. By following the principles of Wealth Dynamics, you can develop strategies that cater to your strengths and make the most of the opportunities that arise.

Understanding Your Wealth Profile

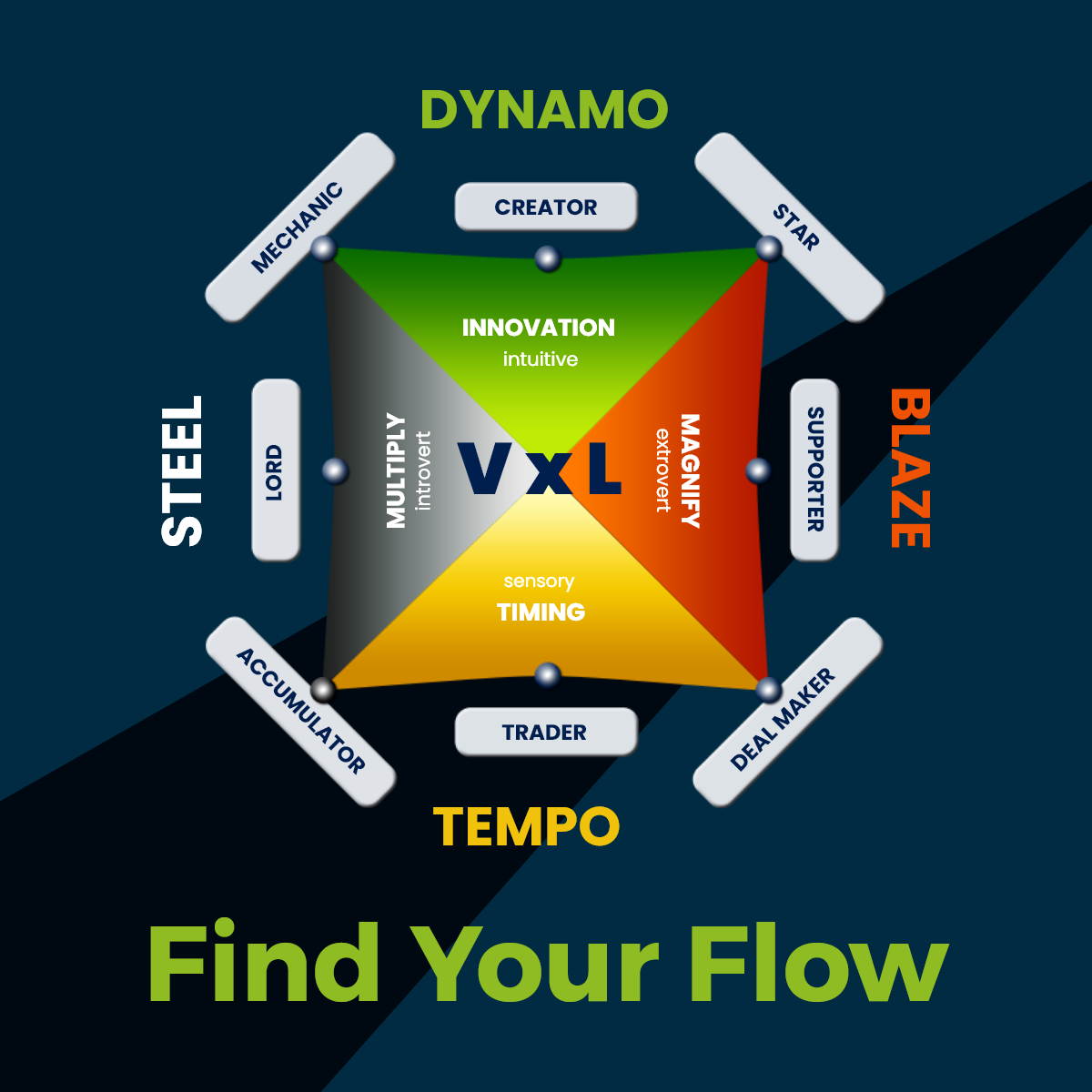

Before delving into trading strategies, it’s essential to understand your Wealth Dynamics profile. Are you a Creator, Mechanic, Star, Supporter, Deal Maker, Trader, Accumulator, or Lord? Each profile comes with its own set of strengths, weaknesses, and preferred approaches to wealth creation.

For traders, profiles like the Deal Maker and Trader often excel in the market due to their natural affinity for risk-taking, negotiation skills, and ability to capitalize on opportunities. However, individuals with other profiles can also succeed by leveraging their unique strengths in trading.

Embracing Flexibility and Adaptability

In a dynamic economy, flexibility and adaptability are key traits for successful traders. Markets can shift rapidly due to various factors such as economic indicators, geopolitical events, and technological advancements. Traders must be willing to adjust their strategies accordingly and seize opportunities as they arise.

Wealth Dynamics encourages traders to embrace their natural inclinations while remaining open to new approaches and opportunities. For example, a Creator might excel in identifying emerging trends and innovative investment opportunities, while a Mechanic might thrive in developing systematic trading algorithms.

Risk Management and Diversification

Effective risk management is essential for traders to protect their capital and maximize returns in a dynamic economy. Wealth Dynamics emphasizes the importance of understanding your risk tolerance and implementing strategies to mitigate potential losses.

Diversification is a key principle advocated by Wealth Dynamics, allowing traders to spread their investments across different asset classes, industries, and geographical regions. This helps reduce the impact of market volatility and provides opportunities for consistent returns over the long term.

Continuous Learning and Improvement

Successful traders understand that learning is a lifelong process. They continuously educate themselves about market trends, new trading strategies, and emerging technologies that can impact the economy.

Wealth Dynamics encourages traders to invest in their personal development and skill enhancement. Whether it’s attending trading seminars, reading financial literature, or networking with other traders, continuous learning is essential for staying ahead in the dynamic market environment.

Conclusion

Mastering the market in a dynamic economy requires a combination of strategic thinking, adaptability, and continuous learning. By leveraging the principles of Wealth Dynamics and understanding your unique wealth profile, you can develop trading strategies that align with your strengths and capitalize on opportunities in the market.

Remember to embrace flexibility, manage risks effectively, and never stop learning and improving your trading skills. With the right mindset and approach, you can navigate the challenges of the dynamic economy and achieve success as a trader.

Ready to take your trading skills to the next level? Start by discovering your Wealth Dynamics profile and unlock personalized strategies for mastering the market. Your journey to trading success begins here! Take the Wealth Dynamics Profile test now