While most people lose money during recessions, certain personality types consistently build wealth when times get tough. Here’s what they do differently.

Every economic downturn creates two distinct groups: those who lose everything and those who emerge wealthier than before. The difference isn’t luck, timing, or even starting capital. It’s about having a wealth-building profile that naturally thrives during uncertainty and market disruption.

History shows us that the same types of people consistently profit during recessions, depressions, and market crashes. They use economic storms as accelerators for building lasting wealth.

The Crisis Opportunity Creators

Some people see problems where others see disasters. During the 2008 financial crisis, while millions lost their homes, certain individuals were buying distressed properties at massive discounts and building real estate empires.

These profiles are naturally innovative and comfortable with uncertainty. They spot opportunities that become obvious only in hindsight but require courage to pursue when everyone else is paralyzed by fear. They create value by solving problems that recession creates.

Their wealth-building approach focuses on identifying what people desperately need during tough times and finding ways to provide it profitably. They often emerge from downturns with entirely new income streams that didn’t exist before the crisis.

The Relationship Leverage Masters

While others retreat and cut connections during hard times, certain profiles double down on relationships and networks. They understand that economic downturns create desperate sellers and motivated buyers, and someone needs to bring them together.

These wealth builders thrive on connecting people and facilitating deals when traditional channels break down. They become more valuable during chaos because their networks become essential lifelines for others trying to navigate uncertainty.

They often make their biggest profits not from their own assets, but from taking pieces of the value they create by bringing the right people together at the right time.

The Market Timing Specialists

Some profiles have an intuitive sense for when markets have hit bottom and when the recovery is beginning. While others are still paralyzed by fear, these wealth builders are making their biggest bets.

They’re comfortable with volatility and actually get energized by market chaos. Where others see unpredictability, they see patterns and opportunities for quick, profitable moves.

Their profits come from being willing to buy when everyone else is selling and having the timing sense to exit before the next downturn begins. They often make years’ worth of normal returns in just months of crisis investing.

The Strategic Asset Accumulators

These profiles take a completely different approach. While others panic sell, they systematically accumulate undervalued assets with a long-term perspective. They understand that recessions are temporary but quality assets are permanent.

They’re naturally analytical and patient, with the emotional stability to invest when markets are at their worst. They don’t try to time the exact bottom; they simply buy quality at significant discounts and wait.

Their wealth comes from the compounding effect of acquiring great assets at recession prices and holding them through the recovery. They often build the foundation of generational wealth during these periods.

The Cash Flow Controllers

During economic uncertainty, cash flow becomes king. Certain profiles instinctively focus on acquiring assets that generate immediate income rather than speculating on appreciation.

They prefer businesses, properties, and investments that pay them monthly or quarterly, regardless of broader economic conditions. They build recession-proof income streams that actually become more valuable when traditional employment becomes unstable.

Their strategy is controlling assets that people need regardless of economic conditions, ensuring their wealth grows even when overall markets decline.

The System Optimization Experts

When budgets get tight, businesses desperately need to become more efficient. Certain profiles naturally excel at helping organizations cut costs and improve processes, making themselves incredibly valuable during downturns.

They get energized by solving operational problems and creating systems that work better with fewer resources. Their expertise becomes more sought after when companies are fighting for survival.

They often build consulting practices or acquire struggling businesses during recessions, applying their optimization skills to create dramatically improved profitability.

Why Most People Miss These Opportunities

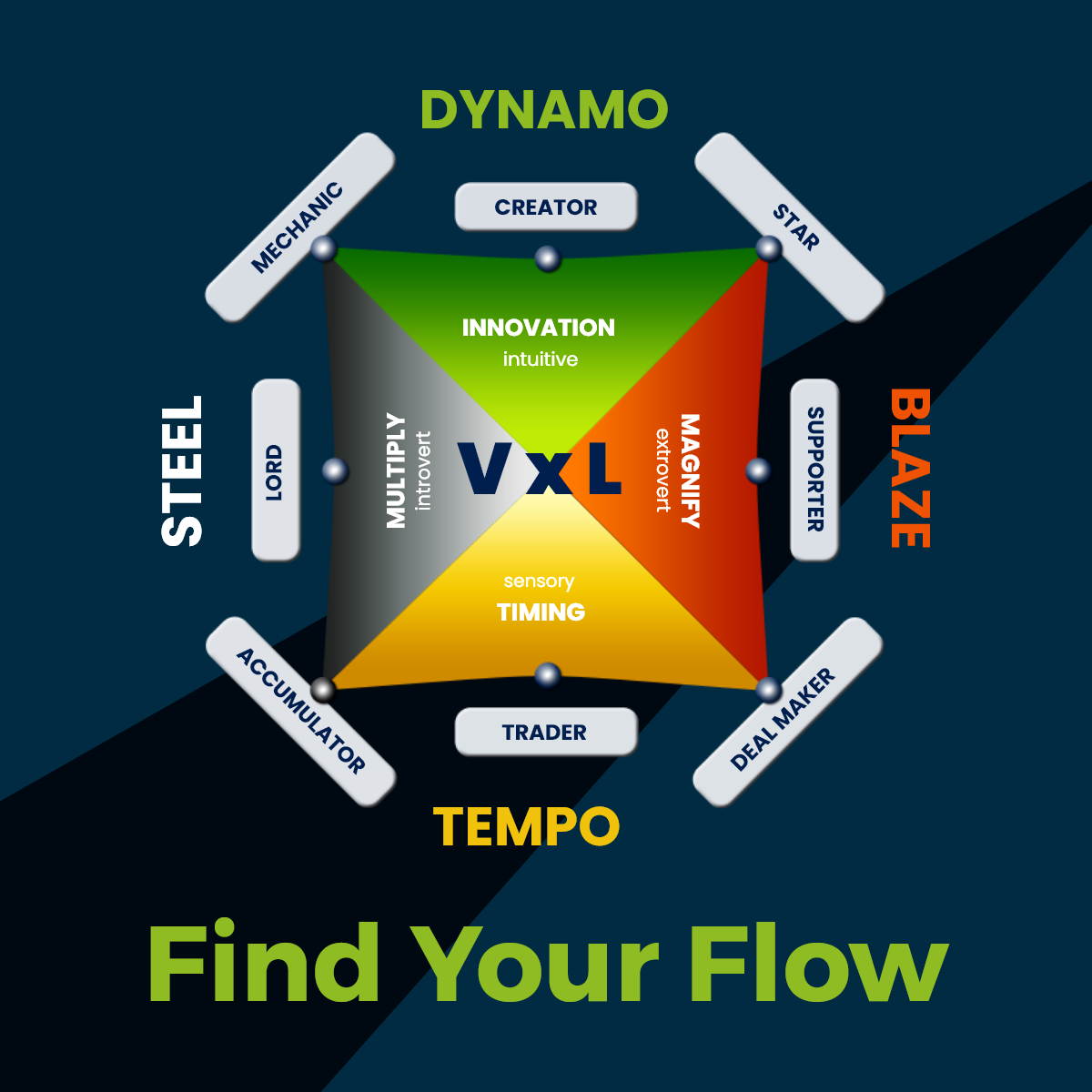

The majority of people approach economic downturns with the wrong mindset for their profile. They try to copy strategies that work for different personality types or follow generic advice that doesn’t match their natural strengths.

Someone who’s naturally relationship-focused shouldn’t try to become a market timer. Someone who’s analytical by nature shouldn’t force themselves to become a deal maker. Working against your profile during crisis leads to poor decisions and missed opportunities.

Understanding your natural wealth-building profile is crucial for navigating economic uncertainty successfully. Each profile has specific strategies that work during downturns and others that lead to disaster.

The key is recognizing which of these approaches energizes you rather than drains you, then positioning yourself to profit when the next downturn inevitably arrives.

Economic downturns are inevitable, but being unprepared isn’t. Understanding your wealth-building profile reveals exactly how people with your natural strengths build wealth during recessions.

The Wealth Dynamics test shows you which of these recession-proof strategies aligns with your profile, plus specific tactics that successful people with your approach use during economic uncertainty.

Don’t wait for the next downturn to discover your natural crisis strategy. Prepare yourself now to profit when others panic.