Bitcoin’s been called everything from a scam to a bubble ready to pop, yet it keeps shrugging off the haters.

Since its 2009 debut, the crypto king has faced relentless predictions of doom from finance bigwigs and pundits, only to emerge stronger each time.

With its price soaring past US$100,000 in 2025, here are five moments Bitcoin flipped the script on its critics, proving it’s here to stay.

- Jamie Dimon’s “Fraud” Flop

JPMorgan CEO Jamie Dimon is as vocally anti-Bitcoin as it gets. In 2017, he threw shade on Bitcoin, calling it a “fraud,” and more recently called the cryptocurrency a “pet rock.” The market laughed: Bitcoin rocketed to US$20,000 by the end of 2017. Fast-forward to 2025, and it’s trading north of US$100K, with JPMorgan having no choice but to allow their clients to buy Bitcoin in May. Dimon’s hot take aged like milk, as Bitcoin’s decentralized allure proved too strong for traditional finance’s skepticism.

- ETF Rejections

When the US Securities and Exchange Commission (SEC) shot down Bitcoin ETF proposals in 2018, social media exploded with “death spiral” hot takes. Bitcoin’s price tanked below US$4,000, and critics smelled blood. But the OG crypto bounced back, hitting new highs by 2021. Institutional money from BlackRock and others, plus halving-driven scarcity, turned the narrative upside down.

- Peter Schiff’s US$2,000 Faceplant

Goldbug Peter Schiff has been one of Bitcoin’s loudest skeptics, notably predicting a crash to US$2,000 in 2019. What actually happened was Bitcoin held steady above US$7,000 for most of the year. Schiff’s bearish rants are now a meme, often signaling a price bottom. Talk about a reverse oracle.

- Calvin Ayre’s Zero-Zero Bet

Billionaire Calvin Ayre bet big against Bitcoin in 2019, claiming it’d plummet to zero as the cryptocurrency had no utility. Spoiler: it didn’t crash. Bitcoin stayed above US$7,000 and kept climbing, fueled by adoption in inflation-ravaged economies and institutional FOMO. Ayre’s prediction is now a footnote in crypto’s victory lap.

- Early Haters Get Humbled

Back when Bitcoin was a nerdy experiment, economists like Nouriel Roubini scoffed, calling it a tulip-style bubble. Despite early hacks and volatility, Bitcoin didn’t just survive. It thrived, morphing into a global asset class. Its 21-million-coin cap and decentralized backbone outsmarted the doubters.

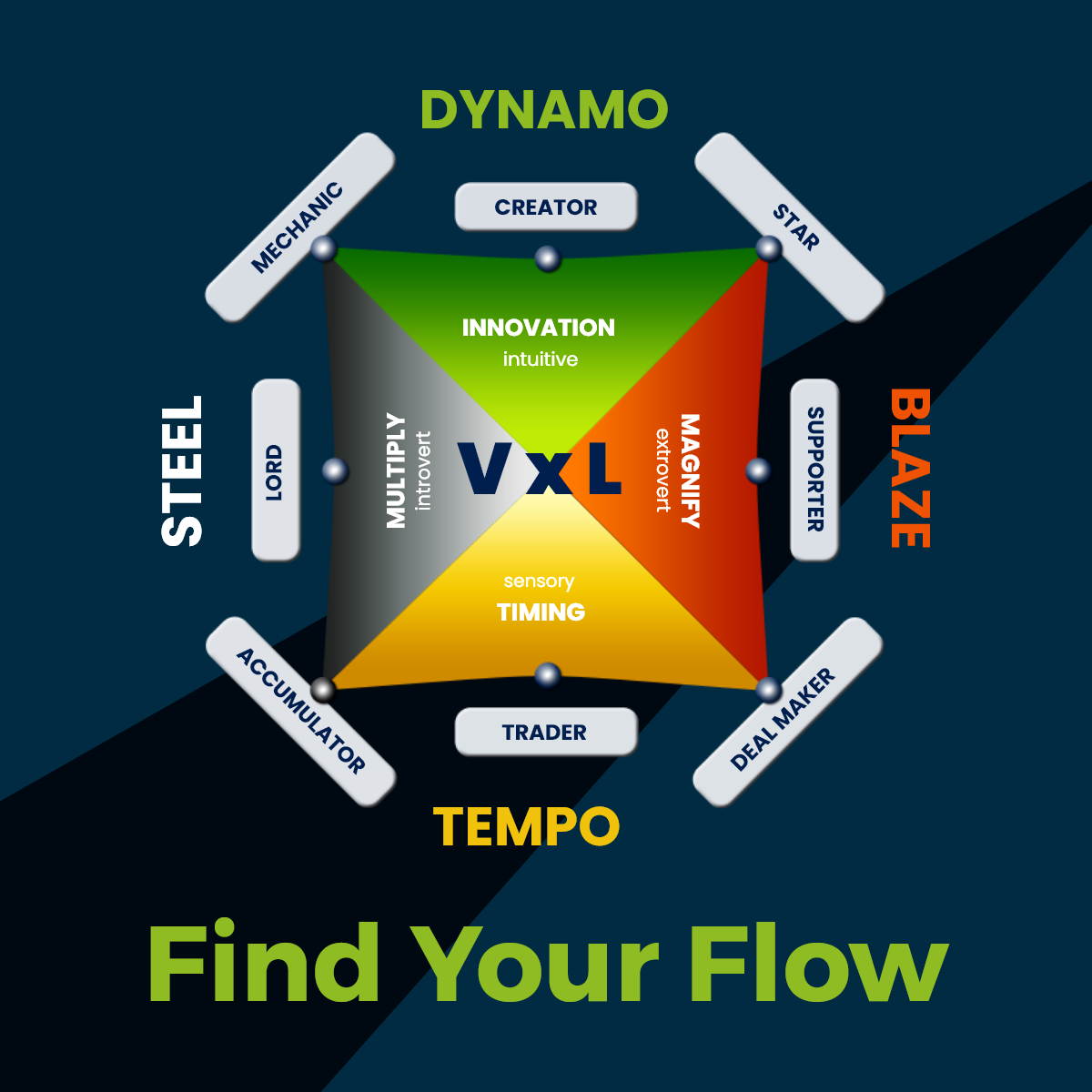

The Takeaway for Founders

Bitcoin’s knack for proving skeptics wrong is a masterclass in resilience for entrepreneurs. Its decentralized tech offers businesses a playbook for borderless payments and blockchain innovation.

To be part of this transformative shift, explore celebrated economist Saifedean Ammous’s The Bitcoin Academy microcourse at Genius Academy, where you’ll learn about the fundamentals of the world’s top cryptocurrency and use the knowledge to reshape your own business opportunities.