You’ve made money with Bitcoin, yet your parents think you’ve joined a cult.

Family dinner is approaching, and you know the questions are coming. “Is that still a thing?” “Didn’t it crash?” “Why don’t you just buy real estate like your cousin?” Here’s your survival guide for explaining Bitcoin to the generation that still writes checks.

What Not to Say

“It’s digital gold.” Your dad will ask where the gold is stored. When you say “nowhere,” he’ll look at you the way he looked at your liberal arts degree.

“It’s decentralized.” Your mom will hear “unregulated” and immediately worry you’ve been scammed. She still doesn’t trust online banking.

“The blockchain is immutable.” You’ve lost them. They’re now thinking about dinner.

“Fiat currency is being debased.” Your dad thinks “fiat” is a car and assumes you’re having another crisis.

The Language Barrier

Your parents’ financial world has physical locations, business hours, and people in suits who can be yelled at when something goes wrong. Bitcoin has none of these things. Their money framework includes: banks you can visit, investments you can see, and assets that someone else vouches for.

Your framework includes: code as law, trustless systems, and private key sovereignty. You might as well be speaking Klingon.

Strategies That Might Work

Start with what they already distrust. “Remember when the bank charged you that ridiculous fee? Bitcoin has no banks.” This works because Boomers love complaining about banks almost as much as they love using them.

Use their own financial history. “You bought your house for $40,000 and it’s worth $600,000 now. Bitcoin went from $1 to $125,000. Same idea, different asset.” They understand appreciation, even if they don’t understand cryptography.

Lead with the problems, not the solution. Don’t start with blockchain technology. Start with “What if you could send money internationally without Western Union taking 15%?” They’ve paid that fee. They hated it.

Avoid the word “mining.” Your dad will picture coal. Absolutely nothing good comes from this conversation direction.

The Questions You’ll Get

“Can’t hackers steal it?” Yes, if you’re careless. Just like someone can steal your wallet if you leave it on a park bench. The difference is Bitcoin can be secured better than physical cash, but this requires you to admit you once lost $20,000 because you forgot your password. Don’t volunteer this information.

“What backs it?” This is the trap question. Your parents’ dollars are “backed” by the government, which sounds legitimate to them despite the government printing money infinitely. Bitcoin is backed by mathematics and network effects. To them, this sounds like a Ponzi scheme.

Try: “What backs gold?” When they say “scarcity and history,” you’ve created an opening. Bitcoin is scarce by design and has 16 years of history now.

“Why can’t the government just ban it?” They could try. Several have tried, yet Bitcoin keeps working. This is actually Bitcoin’s most impressive feature, but explaining why governments can’t stop code running on computers globally requires a conversation about decentralization, and we’ve already established that word doesn’t work.

“Is this why you can’t afford a house?” This is not about Bitcoin. This is about their anxiety that you’re 35 and renting. Redirect immediately: “Real estate is overvalued right now, which is why I’m diversified.” Use the word “diversified.” Boomers love that word.

The Moment You Know You’ve Lost

When your dad says “I’ll stick with my CD at the bank,” he’s not arguing with Bitcoin. He’s reasserting his worldview where safety means FDIC insurance and steady returns mean 3% annually. He lived through periods when this strategy worked. You cannot convince someone that their successful life strategy is now obsolete. Don’t try.

The Nuclear Option

If all else fails: “Microsoft, BlackRock, and Larry Fink own Bitcoin now.”

Name-drop institutional investors. Your parents trust institutions more than they trust you, and this is hurtful but useful. If “serious” people with “real” money are buying Bitcoin, suddenly it’s not your weird internet money anymore.

What to Actually Expect

Your parents probably won’t buy Bitcoin after this conversation. That’s fine. The goal isn’t conversion, it’s reducing the judgment when you mention crypto at holidays. Success looks like: “I don’t really understand it, but I’m glad it’s working for you” instead of “You’re going to lose everything.”

Lower your expectations. They survived with traditional finance and can’t imagine why you’d need something different. You can’t imagine surviving with only traditional finance. You’re both right for your own contexts.

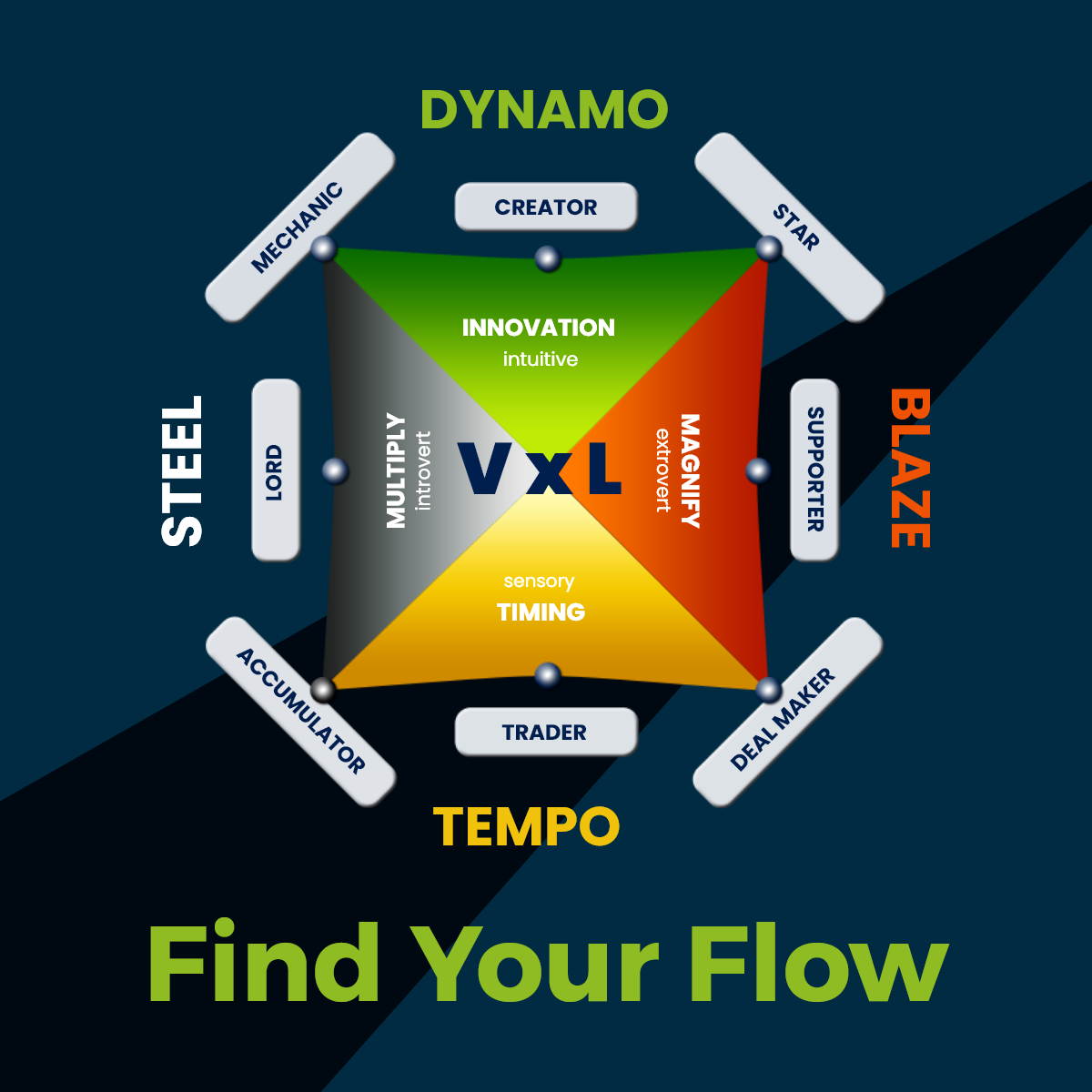

Learn to Communicate Bitcoin Clearly

Struggling to explain Bitcoin to skeptics, family, or potential investors? Understanding the economic foundations and clear messaging strategies helps you communicate Bitcoin’s value to any audience, from Boomers to businesses.

Explore Natalie Brunell’s “How Bitcoin Fixes Money” and Saifedean Ammous’s “The Bitcoin Standard” microcourses at Genius Academy, where you’ll learn to articulate Bitcoin’s value proposition clearly and confidently, regardless of who’s asking.

Master Bitcoin. Then explain it to anyone.