The smartest people in the room are often the poorest.

It’s a paradox that confounds logic, yet plays out daily in boardrooms, universities, and entrepreneurship circles worldwide. How does expertise, which is supposedly our greatest asset, become the very thing that limits our wealth?

The Prison of Perfection

Dean Kamen is a name known all the world over. He’s the brilliant inventor behind over 440 patents, including life-saving devices like the wearable insulin pump and the iBOT wheelchair.

When he launched the Segway in 2001, it was hailed as revolutionary technology that would transform urban transportation. Yet despite its engineering excellence, the Segway failed commercially, struggling with high prices and limited market adoption.

Kamen’s perfectionist approach and focus on technical superiority couldn’t overcome fundamental market realities.

Or consider the countless PhDs and industry experts who spend years refining their business ideas, analyzing every variable, while simpler solutions capture the market they thought they understood. The consultant with decades of experience who can’t pull the trigger on their own venture because they see too many potential complications.

This is the expert trap in a nutshell. It’s where knowledge creates standards that paralysis disguises as thoroughness.

The Curse of Seeing Too Much

Experts suffer from what psychologists call “the curse of knowledge”—they struggle to remember what it’s like not to know what they know. This creates several wealth-limiting behaviors:

Over-engineering solutions that customers neither want nor need. The expert sees nuances and complexities that the market doesn’t value, leading to products that are technically superior but commercially irrelevant.

Analysis paralysis that mistakes research for action. Experts can always find one more study to review, one more variable to consider, one more risk to analyze. Meanwhile, opportunities vanish and competitors with “good enough” solutions capture the market.

Perfectionism masquerading as professionalism. The expert believes that anything less than perfect reflects poorly on their credentials, not realizing that perfect is often the enemy of profit.

The Innovation Paradox

Counterintuitively, deep expertise can actually inhibit breakthrough innovation. Experts are often too invested in existing solutions to imagine radical alternatives. They’ve spent years mastering the current way of doing things, making it psychologically difficult to advocate for approaches that might render their expertise obsolete.

Clayton Christensen’s research on disruptive innovation consistently shows that industry outsiders, not experts, create the most revolutionary changes. The outsiders’ “ignorance” becomes their advantage, as they don’t know what’s supposedly impossible.

Different Types of Intelligence, Different Paths to Wealth

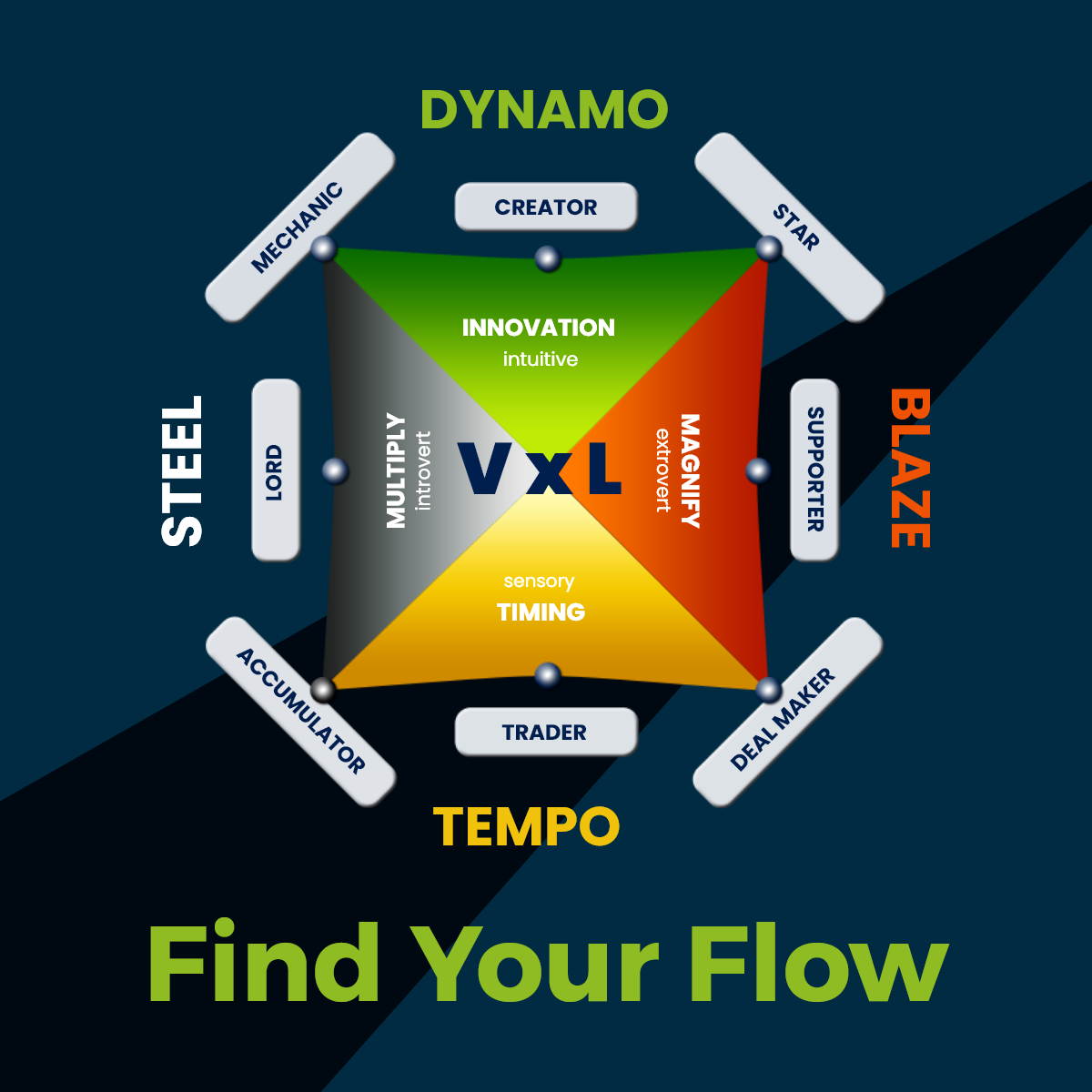

Not all successful people accumulate wealth the same way, and not all types of intelligence translate equally into financial success. Some people build wealth through deep expertise and gradual refinement, in that they’re natural researchers and innovators who eventually monetize their knowledge. Others create wealth through rapid execution and market responsiveness, leveraging “good enough” solutions and superior timing.

The tragedy occurs when natural executors try to become experts, or when natural experts force themselves into execution roles. Both approaches work, but only when aligned with your cognitive strengths and energy patterns.

Breaking Free from the Expert Prison

The solution isn’t to abandon expertise, but it’s to recognize when expertise serves you and when it constrains you. Ask yourself:

Are you using knowledge to create value or avoid risk? Experts often unconsciously use their knowledge as a shield against market feedback, preferring the safety of research to the vulnerability of validation.

Are you solving problems that actually exist? Your expertise might blind you to what customers truly care about versus what you think they should care about.

Are you building for experts or for users? The market rarely rewards the most technically sophisticated solution; it rewards the one that best serves customer needs.

The Sweet Spot of Informed Action

The most successful people are those who know enough to make informed decisions but aren’t paralyzed by knowing too much. They understand their knowledge boundaries and complement their expertise with rapid market feedback.

True wealth often comes from applied knowledge, not accumulated knowledge. The expert who learns to act despite incomplete information, who can simplify complex ideas for mass consumption, and who values market validation over academic validation, escapes the expert trap.

Your knowledge is an asset, not a prison sentence. The key is learning when to open the door and step into the uncertainty of the marketplace. Because that’s where knowledge transforms into wealth.

If you want to discover your natural approach to turning knowledge into wealth, take the free Wealth Dynamics test. Uncover whether you’re wired to build wealth through expertise or execution, how to avoid the common traps of your learning style, your optimal balance between research and action, and the business models that reward your natural approach to knowledge.