“Just HODL” has become the rallying cry of Bitcoin enthusiasts worldwide. But here’s what the Bitcoin community doesn’t want to admit: HODL isn’t a strategy that works for everyone.

For many investors, blindly following this advice has led to significant losses and missed opportunities.

The uncomfortable truth is that successful Bitcoin investing isn’t just about understanding blockchain technology, it’s also about understanding yourself.

The HODL Myth

HODL (hold on for dear life) originated from a misspelled forum post during Bitcoin’s early days, but it’s since been elevated to almost religious doctrine. HODL works beautifully for some people, as they can watch their portfolio swing wildly without losing sleep and genuinely believe in Bitcoin as digital gold. But for others, HODL is psychological torture that leads to panic selling at the worst possible moments.

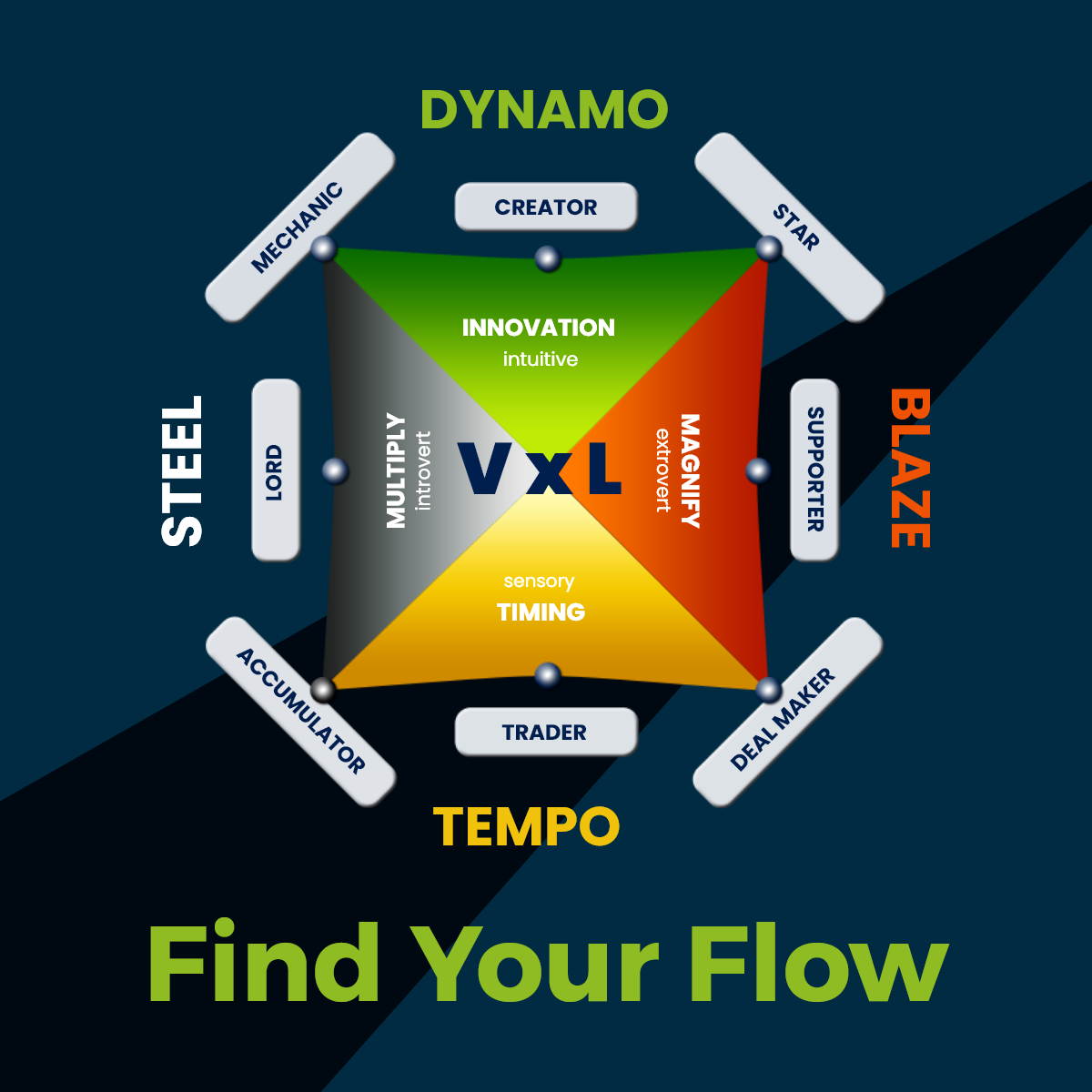

The Four Bitcoin Personalities

The True Believer thrives with HODL because they view Bitcoin as inevitable technology rather than speculation. Their conviction strengthens during downturns.

The Active Trader struggles with pure HODL because they’re energized by market activity. They perform better with dollar-cost averaging or tactical adjustments.

The Risk Manager needs structured approaches with clear exit strategies. Pure HODL creates anxiety because it lacks the risk controls they psychologically require.

The Social Investor is heavily influenced by community sentiment and needs external validation. They succeed by following trusted influences but are vulnerable to FOMO.

Why One Size Fits None

Consider two investors who bought Bitcoin at $60,000 in 2021. The True Believer watched it drop to $15,500 without selling, eventually seeing recovery and profit. The Risk Manager sold at $30,000 to preserve capital, then bought back at $25,000 with a smaller position. Both strategies reflect their psychological makeup, and both could achieve similar long-term results.

Bitcoin’s volatility creates psychological stress that affects people differently. Some thrive on the uncertainty; others find it debilitating. Successful Bitcoin investing requires honest self-assessment: Are you genuinely comfortable with 80% drawdowns, or white-knuckling through them?

The most sophisticated investors develop hybrid strategies matching their psychological profile through core positions plus trading allocations, systematic profit-taking, or stress-tested position sizing.

Your personality determines how you’ll react during Bitcoin’s boom-bust cycles. The investors who succeed long-term aren’t necessarily the smartest. They’re those whose strategies align with their natural behavioral patterns. Fighting your psychology leads to emotional decisions at exactly the wrong times.

Master the Bitcoin Standard: Beyond Just Psychology

Understanding your investment psychology is crucial, but it’s only part of the equation. To truly succeed with Bitcoin, you need the economic principles that make it revolutionary.

Saifedean Ammous, author of “The Bitcoin Standard,” has created an exclusive microcourse exploring the Austrian economics foundations that make Bitcoin the hardest money in human history. The course offers an understanding why Bitcoin represents a paradigm shift most investors miss.

Available exclusively at Genius Academy, covering why Bitcoin is superior to gold, the economic theory explaining its trajectory, and the Austrian School principles that predicted its emergence.