“Fail fast, fail often” has become Silicon Valley’s favorite mantra. It sounds bold, innovative, and fearless. Venture capitalists love it, conference speakers repeat it, and startup founders tattoo it on their forearms.

But here’s the actual truth: for most entrepreneurs, failing faster just means going broke quicker.

The Myth’s Origin Story

The “fail fast” philosophy came from tech companies with venture capital backing, running cheap software experiments where failure meant shutting down a prototype, not shutting down your life. When you have $5 million in funding and failing means pivoting to version 2.0, failure is indeed a learning opportunity.

When you bootstrapped your business with savings, failing fast means explaining to your spouse why you can’t pay the mortgage. Slightly different emotional stakes.

What Silicon Valley Forgot to Mention

The entrepreneurs preaching “fail fast” usually have financial runway measured in years, not months. They’ve had multiple attempts already funded before their first success. They have networks that catch them when experiments fail and options to return to high-paying jobs if needed.

You probably have credit card debt funding your dream, one realistic shot before returning to employment, a family depending on your income, and no safety net except your parents’ disappointment.

The advice works differently when you’re not operating from a position of financial privilege.

The Hidden Costs Nobody Counts

Every failure costs more than the failed business. It costs relationships strained by financial stress, credit scores damaged by business debt, years of career progression lost, mental health deteriorated by repeated rejection, and networks that stop taking your calls after attempt three.

“Fail fast” advocates count the learning. They don’t count the collateral damage.

The Personality Trap

Some entrepreneurs hear “fail fast” and internalize it as permission to quit when things get hard. Others use it to excuse poor planning and rushed execution. Different personality types weaponize this advice differently:

The serial starter launches businesses faster than they can sustain them, confusing activity with progress. They fail fast because they never commit long enough to succeed.

The overthinker uses “fail fast” to override their natural caution, making reckless decisions because patience feels like weakness. They fail fast because they stopped using their best judgment.

The optimist interprets every failure as valuable learning while ignoring patterns showing they’re failing for the same reasons repeatedly. They fail fast and learn nothing.

What Actually Works

Successful entrepreneurs don’t fail fast. They learn fast. These are not the same thing.

Learning fast means testing assumptions quickly without betting everything on each test. It means small experiments with limited downside, not burning through capital to prove obvious problems exist.

The better advice: validate cheaply, scale carefully, fail small.

Test your business model with minimum viable experiments, launch with just enough to learn whether customers actually want what you’re selling, and get paying customers before hiring a team. Prove demand before building supply.

This is less exciting than “fail fast,” but it also leads to fewer catastrophic failures.

The Survivorship Bias

Every successful entrepreneur who preaches “fail fast” survived their failures. They’re here to tell the story because they didn’t actually fail completely; they failed forward into eventual success.

We don’t hear from the entrepreneurs who failed fast and never recovered. They’re not keynoting conferences about their valuable lessons; they’re working corporate jobs wondering what happened.

You’re only seeing the survivors.

When Failing Fast Makes Sense

There are legitimate situations for rapid failure: testing hypotheses with minimal investment, discovering market assumptions were wrong, learning technical approaches won’t work, and finding customer segments don’t exist.

But even then, “fail fast” means “learn quickly and adjust,” not “burn money faster to fail spectacularly.”

Build Sustainable Business Strategies

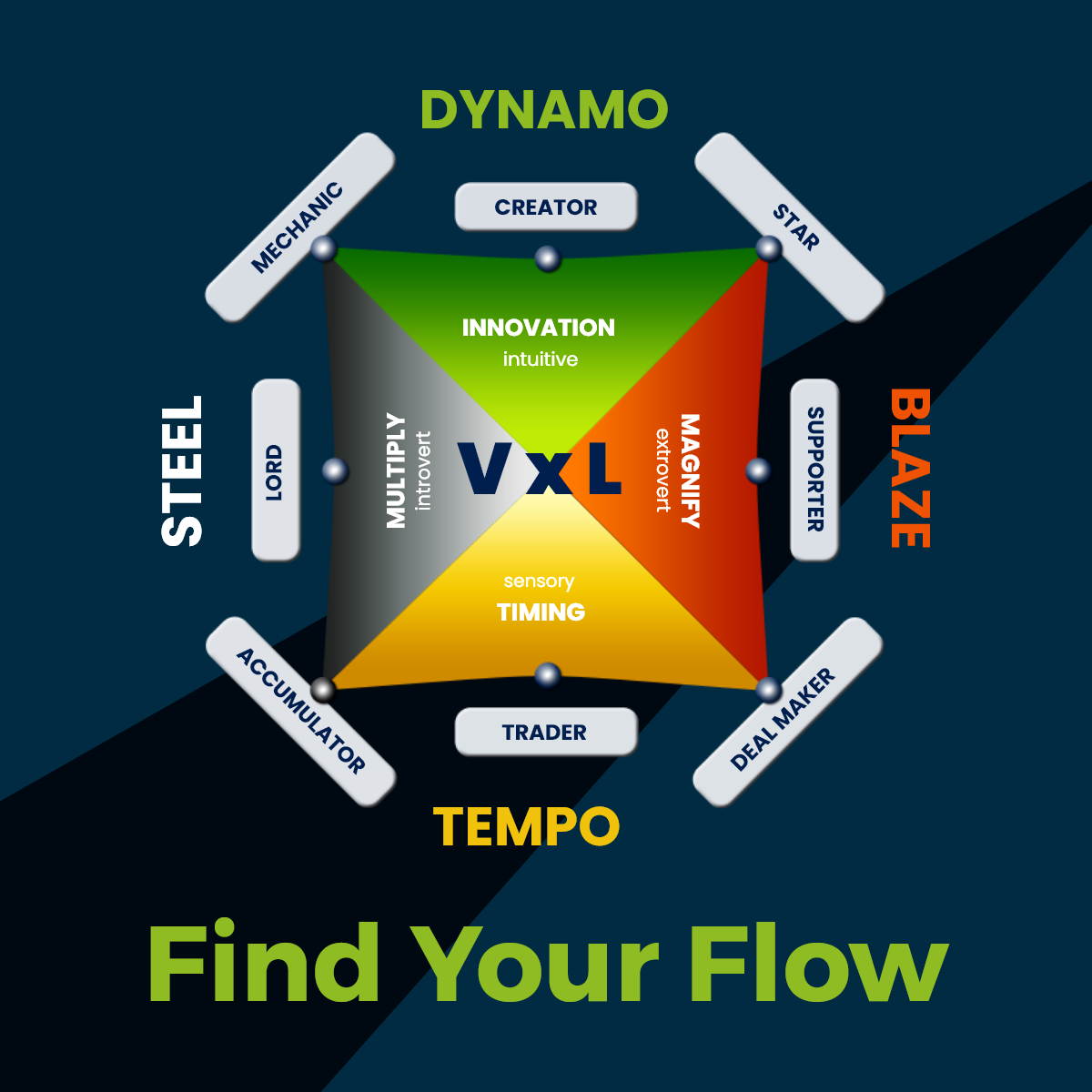

Real entrepreneurial success comes from understanding your natural strengths and building business models that work with your resources and personality, not from blindly following Silicon Valley mantras designed for venture-backed experiments.

Discover your entrepreneurial profile and learn to build sustainable businesses aligned with your strengths through the Wealth Dynamics Test. Don’t fail faster. Succeed smarter.