Despite following all the “expert” advice, your portfolio still isn’t delivering the results you expected. Here’s why, and what to do about it.

You’ve read the books, followed the gurus, and implemented their strategies. Yet your investment returns remain disappointing while others seem to effortlessly grow their wealth. The problem may not lie in your dedication or intelligence. Instead, you may be following advice designed for someone else’s personality and circumstances.

Here are six critical reasons why your current investment approach may be working against you, and how understanding your natural investing style can transform your results.

- You’re Following a One-Size-Fits-All Strategy

The biggest myth in investing is that there’s a universal approach that works for everyone. Financial media promotes the idea that all successful investors should think like Warren Buffett or trade like day traders, but this ignores a fundamental truth: different personality types naturally excel at different investment approaches.

Some investors thrive on detailed analysis and long-term patience, while others have intuitive timing and excel at shorter-term opportunities. Trying to force yourself into an incompatible investing style is like forcing a naturally creative person to become an accountant. In other words, it might work temporarily, but it’s not sustainable.

- Your Strategy Drains Your Energy Instead of Energizing You

Successful investing requires consistency over time, but maintaining consistency is nearly impossible when your approach exhausts you. If researching stocks feels like torture, you’re probably not a natural analyst. If watching market volatility keeps you awake at night, active trading isn’t your path.

The most successful investors have found approaches that energize rather than drain them. They look forward to their investment activities because they align with their natural interests and strengths. When investing feels like work, you’re fighting your psychology instead of leveraging it.

- You’re Trying to Be Good at Everything

Many investors fall into the trap of thinking they need to master every investment vehicle, namely stocks, bonds, real estate, commodities, cryptocurrencies. But the wealthiest investors typically focus on their areas of natural strength and either avoid other areas or partner with experts who excel there.

Some naturally understand real estate markets and leverage. Others have an intuitive feel for growth companies or market timing. Still others excel at building businesses and using those profits to fund their investments. Spreading yourself too thin prevents you from developing deep expertise in your natural area of strength.

- You’re Ignoring Your Risk Tolerance

Risk tolerance isn’t just about how much volatility you can stomach, but about what type of risk energizes you versus what type paralyzes you. Some investors are comfortable with business risk but hate market volatility. Others love the excitement of trading but would never start a business.

Most investment advice treats risk as a simple scale from conservative to aggressive, but it’s actually multidimensional. Understanding which types of risk you naturally handle well, and which ones you should avoid, is crucial for building a sustainable investment approach.

- Your Investment Timeline Doesn’t Match Your Personality

Investment timelines are about what timeframe feels natural to you. Some people have the patience and perspective for decade-long investments, while others naturally think in shorter cycles.

Forcing a naturally impatient person into a buy-and-hold strategy often leads to poor timing decisions. Similarly, pushing someone who prefers long-term thinking into active trading typically results in missed opportunities and excessive costs. Your investment timeline should match your natural decision-making rhythm.

- You’re Investing in Isolation Instead of Leveraging Your Network

The most successful investors understand that wealth building is a team sport. They don’t try to master every aspect of investing themselves, and they build relationships with people who complement their strengths.

Some investors are natural networkers who excel at finding opportunities through relationships. Others are systematic researchers who need partners with market intuition, while some are great at identifying trends but need detail-oriented partners to execute. Your investment strategy should leverage your natural networking and collaboration style.

Finding Your Natural Investment Approach

To identify your optimal investment style, consider these questions: What type of financial content do you naturally gravitate toward? When making investment decisions, do you prefer detailed analysis or quick intuitive judgments? Do you get energized by market volatility or prefer stability? Are you more interested in creating value or preserving it?

Your answers reveal your natural investment personality and the strategies most likely to work for you long-term.

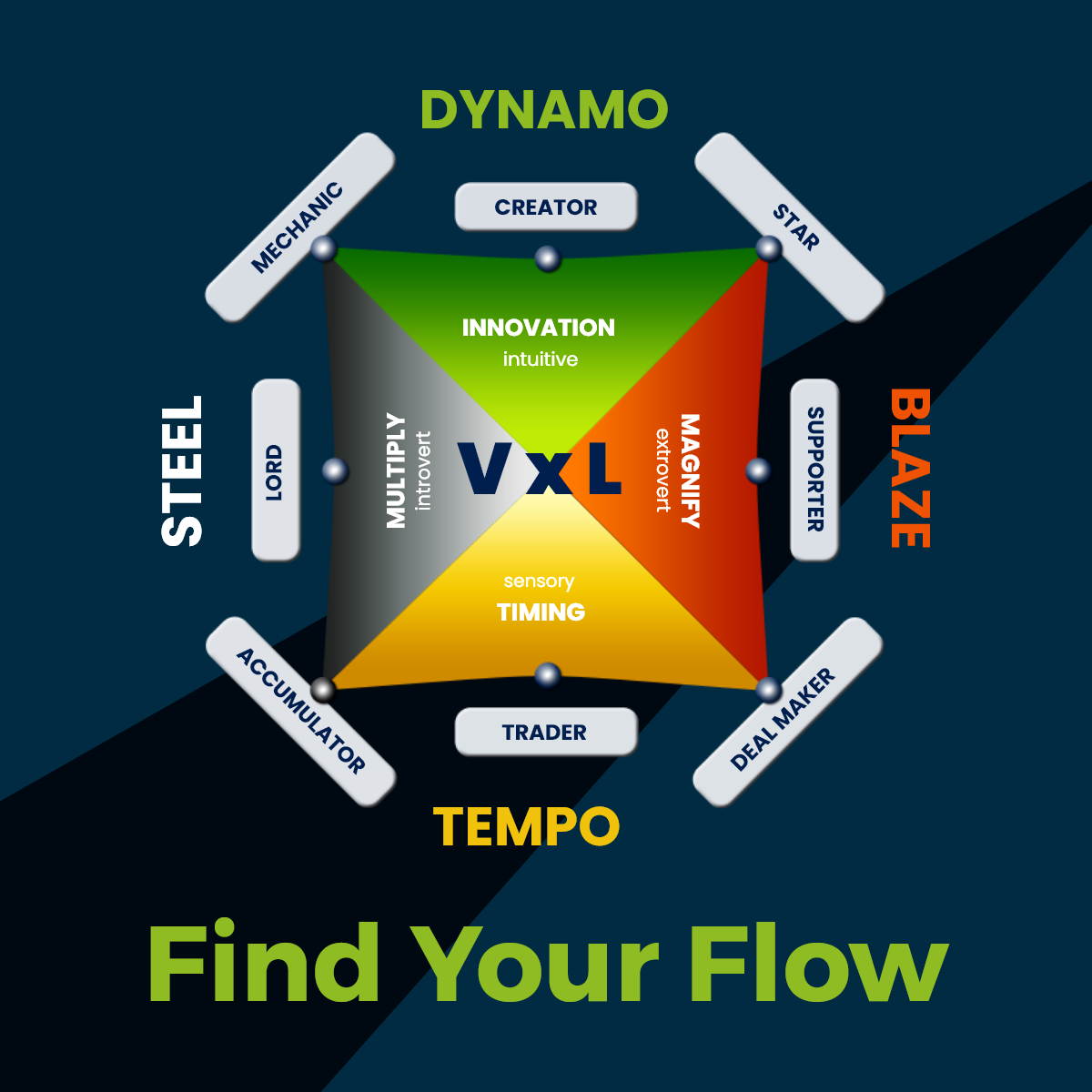

Ready to stop fighting your instincts and start leveraging them? The Wealth Dynamics test reveals your unique wealth-building profile and shows you exactly which investment strategies align with your personality. Stop trying to fit into someone else’s investment strategy. Discover the approach that’s designed for your brain.