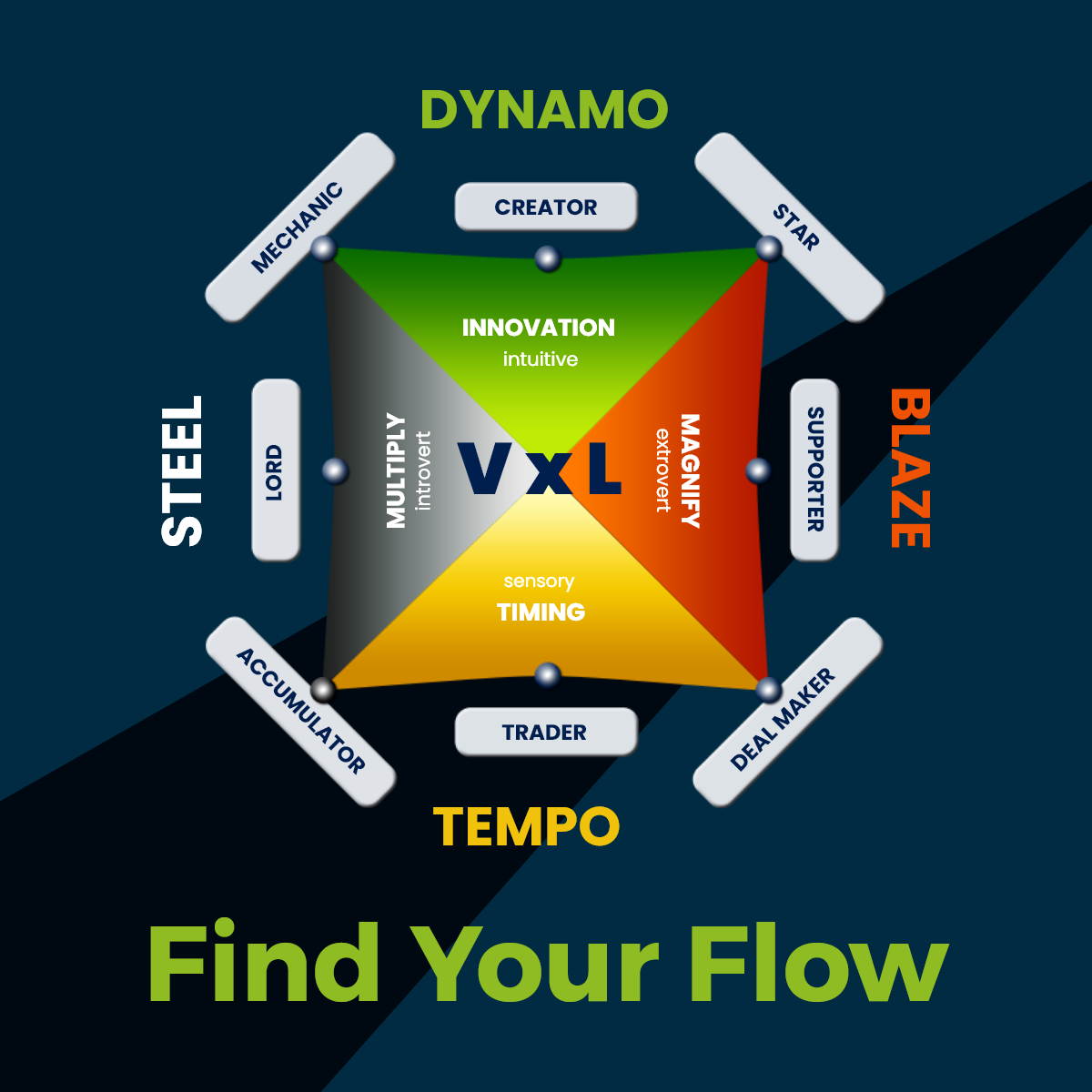

In the realm of wealth creation, the ability to engineer financial efficiency is a coveted skill. Just as a mechanic fine-tunes a machine for optimal performance, individuals with the ‘Mechanic’ Wealth Dynamics profile possess a unique knack for designing and optimizing systems to drive financial success. In this article, we’ll delve into the power of systems and explore how Mechanics can leverage their innate strengths to engineer unparalleled financial efficiency.

Understanding the Mechanic Profile

Before we delve into the intricacies of financial efficiency, let’s first understand what it means to be a ‘Mechanic’ in Wealth Dynamics. Mechanics are individuals who thrive on creating and perfecting systems. They possess a keen eye for detail, a methodical approach to problem-solving, and an innate ability to optimize processes for maximum output.

Designing Robust Financial Systems

At the core of financial efficiency lies the ability to design robust systems that streamline wealth generation and management. Mechanics excel in this arena by meticulously analyzing existing processes, identifying inefficiencies, and implementing tailored solutions to enhance overall performance.

For example, a Mechanic may develop automated budgeting systems that track expenses, identify areas of overspending, and allocate resources effectively. By creating such systems, Mechanics can maintain financial discipline and ensure that every dollar is allocated with purpose.

Optimizing Investment Strategies

Investing is inherently a system-driven process, and Mechanics are well-equipped to excel in this domain. Leveraging their analytical prowess, Mechanics can design investment strategies that are aligned with their risk tolerance, financial goals, and market conditions.

Mechanics may gravitate towards long-term investment approaches that prioritize stability and consistent returns. They meticulously research investment opportunities, diversify their portfolios, and implement risk management protocols to safeguard their wealth against market volatility.

Continuous Improvement and Adaptation

One of the hallmarks of Mechanics is their commitment to continuous improvement. They understand that financial efficiency is not a one-time achievement but a journey of ongoing refinement and adaptation. Mechanics regularly review their systems, identify areas for enhancement, and implement iterative changes to optimize performance further.

Moreover, Mechanics are adept at adapting to evolving financial landscapes. They stay abreast of market trends, technological advancements, and regulatory changes, ensuring that their systems remain agile and resilient in the face of uncertainty.

Conclusion: Unleashing Financial Efficiency

Mechanics possess a unique set of skills that empower them to engineer unparalleled financial efficiency. By designing robust systems, optimizing investment strategies, and embracing continuous improvement, Mechanics can unlock the full potential of their wealth creation endeavors.

Whether you resonate with the Mechanic profile or aspire to incorporate system-driven approaches into your financial toolkit, remember that the power of systems lies in their ability to amplify your efforts and propel you towards financial success.

Ready to engineer your financial efficiency? Take the Wealth Dynamics Test now and discover your unique wealth profile!